Leverage Products

Winning with Spot Leverage: Lessons from 2025's Best Traders

In 2025, Index Coop ran one of the most consistent and onchain-native trading competitions in crypto: Trade of the Month. Let’s ...

12/16/2025

Leverage Products

Leverage RUSH: 150k INDEX Rewards for Traders

Raffle Unleashed, Season of Hype. We’re giving away 150,000 $INDEX to active traders using the Index Coop Leverage Suite across ...

10/20/2025

Leverage Products

Sharpshooters | S1 of Index Coop’s Onchain Trading Competition

Trade onchain. Win cash. Claim glory. Every month, Index Coop rewards top traders with real prizes and collectible NFT trophies.

4/17/2025

Leverage Products

Introducing The Ratios: Leveraged ETHBTC

ETH2xBTC and BTC2xETH provide traders leveraged exposure to the ratio and are now live on Arbitrum.

12/23/2024

Leverage Products

Leverage Tokens vs Perps

In this video, we explore the three main benefits of trading using leverage tokens versus perps platforms.

12/10/2024

Leverage Products

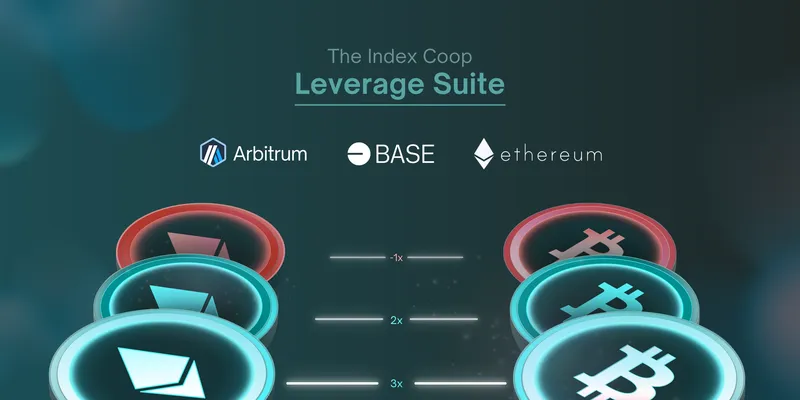

A Beginner’s Guide to The Index Coop Leverage Suite

Whether you’re new to DeFi or looking to simplify your trading, this video breaks down how these tokens work and why they stand ...

10/15/2024

Leverage Products

Unlocking Leverage on Base

The Index Coop Leverage Suite is live on Base.

9/11/2024

Leverage Products

Understanding Leverage Tokens vs Perps

What are the key differences between real and synthetic leverage in DeFi?

5/29/2024

Leverage Products

Introducing the Index Coop Arbitrum Leverage Suite

Index Coop launches a range of automated leverage products on Arbitrum

5/28/2024

Leverage Products

Index Coop Leverage Suite FAQ

This article includes answers to some of the most frequently asked questions regarding Index Coop leverage tokens.

5/28/2024

Leverage Products

How Leverage Tokens Perform in Different Market Conditions

Learn how ETH2x tends to perform in three different market conditions: a persistent uptrend, a persistent downtrend, and a volat...

5/1/2024

Leverage Products

How volatility drift impacts your leverage tokens

The long-term performance of leverage tokens doesn’t always match the expected multiple implied by the leverage ratio, especiall...

3/20/2024

Leverage Products

2x Leverage Tokens FAQ

All your questions about the new 2x leverage tokens answered.

3/20/2024

Leverage Products

How to unwrap your FLI tokens

We've migrated the FLI tokens to new BTC2x and ETH2x tokens. Here's how to exit your position.

3/12/2024

Leverage Products

Meet the Index Coop's new 2x Leverage Tokens

The Index Coop's ETH2x-FLI and BTC2x-FLI tokens have been replaced by new and improved 2x tokens

3/12/2024

Leverage Products

How to earn additional yield by minting MNYe tokens and LPing

The Market Neutral Yield ETH token from the Index Coop

8/3/2022